The presidential election. Wild rides on Wall Street. Worry over international issues. Terrorism. Concern about energy prices and rising costs outside of any business owner’s control. (Hello, health care.) The challenge of finding and keeping good workers.

As 2015 came to a close and the New Year settled in, these were just some of the weighty concerns floral industry members were grappling with, according to results from a year-end, fourth-quarter survey conducted by the Society of American Florists.

Oh, yeah: And the prospect of a Sunday Valentine’s Day on a holiday weekend, too.

Overall, 44 percent of respondents to the survey — which queried retailers, growers and wholesalers, importers and suppliers — said business was good at the start of 2016, and 41 percent said they were optimistic about business this year.

Still, while no one is comparing the current economy to the disaster zone surrounding 2008, the mood among many industry members seems centered on tempered expectations and wait-and-see attitudes. It’s as if a whole lot of people are saying, “Things are okay right now, but …”

This week, we’ll take a more in-depth look at those results, focusing in on the key challenges retailers, wholesalers, suppliers, importers and growers face, and the ways respondents predict their businesses might change in 2016.

Business is (Pretty) Good

While 44 percent of total respondents to the SAF survey said business is good, 41 percent said it’s merely okay, and 8 percent said it’s poor. Percentages were smaller at both extremes: About 6 percent said business is excellent and 1 percent said terrible.

A handful of respondents noted trepidation over a slow start to the New Year.

“The local economy is challenged,” a florist in Massachusetts explained. “ first two weeks of January, down by 60 orders from last year.”

“January sales are slower than anticipated,” a Pennsylvania florist agreed. “We are off so far a good 20 percent.”

The state of business among retailers varied by region and size, although most respondents said things are good or okay (respondents could also offer more enthusiastic responses—excellent — or more dismal — poor and terrible — but the majority stuck with good and okay).

Perhaps not surprisingly, the largest shops, those with $1 million or more in sales, appear to be feeling the best: 52 percent of those respondents said business is good. (Thirty-two percent said it is okay.) By comparison, among retailers with:

- less than $300,000 in annual sales: 41 percent, good. 41 percent, okay.

- $300,000 to $499,999 in annual sales: 39 percent, good. 50 percent, okay.

- ·$500,000 to $999,999 in annual sales: 44 percent, good. 38 percent, okay.

Self-described rural and suburban florists seem slightly more upbeat than their counterparts in urban areas and small towns:

- Rural: 50 percent, good. 29 percent, okay.

- Suburban: 50 percent, good. 34 percent, okay.

- Urban: 43 percent, good. 39 percent, okay.

- Small town: 35 percent, good. 53 percent, okay.

And, florists in the Northeast appear more bullish than retailers in other parts of Canada and the U.S., particularly those in the American South

- Northeast: 59 percent, good; 34 percent, okay.

- Midwest: 46 percent, good. 39 percent, okay.

- West: 38 percent, good. 34 percent, okay.

- Canada: 33 percent, good. 56 percent, okay.

- South: 32 percent, good, 50 percent, okay.

Beyond retailers, 50 percent of growers said business is okay and 43 percent classified it as good. Only 7 percent said it’s bad

Among wholesalers, suppliers and importers (classified, for survey purposes, as one group), 60 percent said business is good, 30 percent said it’s okay, and 10 percent said it’s terrible

The Year Ahead: Mostly Sunny with a Chance of an Apocalypse (Kidding. Kidding.)

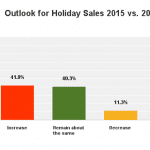

About 41 percent of all respondents say they are “neutral or uncertain” about sales expectations for 2016. Another 41 percent said they are optimistic. Meanwhile, 9 percent said they are pessimistic, and 8 percent said they are very optimistic. Less than one percent said they are very pessimistic.

Breaking those numbers down by segment, retailers seem slightly less optimistic than their counterparts: 40 percent of retailers are optimistic, compared to 50 percent of growers and 50 percent of wholesalers, suppliers and importers.

What’s behind their hesitation? Issues big and small, inside the industry and outside of it… And, for that matter, inside the country and outside of it.

Record low oil prices, for example, may be good for some consumers and business owners, but in areas that depend on the oil and natural gas industry, crashing prices — from $100 a barrel to less than $30, at press time, according to CNBC — make for wary retailers.

“Our area depends on the oil and gas industry,” said one Texas retailer. “ production dropping and rising unemployment, not much room for optimism.

Steep drops in the stock market, and the surrounding media coverage, are not helping a jumpy public feel confident either, noted a number of responses.

“With the stock market as it is, I don’t want to even think what could happen with sales to my business,” worried a retailer in Pennsylvania.

“I think are still a little trigger happy on reactions, pulling in spending on negative news,” added a Minnesota florist. “That will affect our luxury business model.”

Also damaging? The news that high profile national businesses are suffering. An Oregon florist pointed out, both Wal-Mart and Macy’s have recently announced significant store closings around the country.

And, in case you’ve been living (blissfully) in a cave for the past six months, this year brings a presidential election — and an election season that’s been anything but standard. As one wholesaler based in California explained, particularly when paired with other factors, “ election year, stock market uncertainty oil prices adversely affecting segments of the economy,” he said.

(In fact, when SAF surveyed members at the end of 2011, before the last presidential election, 46 percent of respondents felt optimistic heading in 2012, 29 percent said they were neutral, 16 percent were pessimistic, and 9 percent were very optimistic.)

Florists in Canada pointed to another worry: the exchange rate between the two countries.

“The U.S. dollar is creating a big strain on our costs, as we are experiencing huge price increases due to the Canada-U.S. exchange rates,” one retailer out of Toronto noted.

Casting their eyes forward to February and Valentine’s Day, few industry members saw much hope in the mega holiday, situated as it is on a Sunday and long weekend. (Read more about Valentine’s Day predictions.)

“The overall economy and stock market woes combined with a Sunday Valentine’s create headwinds that will be tough to overcome,” explained a Tennessee florist, who also lamented a “continuing slide” in sympathy sales and the “relative generational disinterest” in flowers among 25- to 49-year-olds.

Slicing into Sales Data

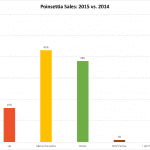

The survey also asked respondents to compare 2015 gross sales to 2014 results. On this front, 54 percent of retailers reported higher returns, and 43 percent of growers said gross sales were up. Sixty percent of wholesalers, suppliers and importers said gross sales rose. But, of course, those upticks were not universal. Less rosy returns include:

- Growers: 43 percent, about the same. 14 percent, down.

- Retailers: 23 percent, about the same. 23 percent, down.

- Wholesalers, suppliers and importers: 20 percent, about the same. 20 percent, down.

Zooming in beyond gross sales for the year, compared to the fourth quarter of 2014, 2015 fourth quarter sales were up for 47 percent of all respondents (growers, retailers and wholesalers, suppliers and importers combined), down for 28 percent and about the same for 24 percent.

Other interesting findings include:

Among those respondents who experienced a decrease in fourth quarter sales in 2015:

- 58 percent said the drop was between 1 and 10 percent, compared to the fourth quarter of 2014.

- Thirty-two percent said it was between 11 and 20 percent.

- About 9 percent said it was between 21 and 50 percent.

- A small percentage, about 1 percent, said it was more than 51 percent.

Among those respondents who experienced a sales increase in fourth-quarter sales:

- 70 percent said it was between 1 and 10 percent.

- 21 percent said it was between 11-20 percent.

- 8 percent said it was between 21 and 50 percent.

- 2 percent, said it was 51 percent or more.

Among those respondents who said net profits were down from the same quarter last year:

- 60 percent said that drop was between 1 and 10 percent.

- 26 percent said it was 11 to 20 percent.

- 13 percent said it was 21-30 percent

- 1 percent said it was more than 51 percent.

Among those who said net profits are up from the same quarter last year:

- 81 percent said they are 1-10 percent higher.

- 15 percent said they rose between 11 and 20 percent.

- 3 percent said they were up 21-30 percent.

- Less than one percent said they were up by 51 percent or more.

Cost Countdown

Another frustration? Costs. Costs. Costs.

“Our overhead costs are going up,” said a California florist, noting that the state has raised its minimum wage to $10 per hour. “Our city is raising again in January 2017.”

Rules and regulations also presented challenges to a nursery grower in California, who noted, “we are required to cut back on our water use due to the drought in California. We had to cut a small percentage of production in order to meet our required cuts.”

Managing inventory and keeping freight and transportation costs in check poses another challenge, said a grower headquartered in Florida.

And, health care. Oomph. Health care, said a Pennsylvania florist. “Even though we are below the threshold for Obamacare, we are still spending a considerable amount of time on our shop health care,” time — and money — no doubt, he’d rather be putting elsewhere

Spending Sources

The SAF survey asked all respondents to weigh in on how they expect their spending in key areas to line up in 2016, compared to 2015:

- Perishables: Up, 29 percent; Down, 18 percent; Same, 48 percent; Uncertain, 5 percent

- Hard goods: Up, 26 percent; Down, 16 percent; Same, 51 percent, Uncertain, 3 percent; N/A, 3 percent

- Giftware: Up, 13 percent; Down 29 percent, Same, 36 percent; Uncertain, 9 percent; N/A, 13 percent

- Capital Investments: Up, 15 percent; Down 25 percent; Same, 33 percent; Uncertain, 18 percent; N/A, 10 percent

- Energy: Up 20 percent; Down 22 percent; Same, 49 percent; Uncertain, 6 percent; N/A, 2 percent

Looking at the same series of questions by segment:

- Forty-six percent of retailers predict perishable products spending to be about the same in 2016. 52 percent said hard goods will be about the same. About 31 percent said giftware spending will be down, although about 38 percent said it should be about the same. About 32 percent of retailers say capital investment spending will be about the same; a quarter say it will be down. Fifty percent said energy spending will be about the same.

- Three-quarters of growers predict perishable product spending will be the same. A third of growers say capital investment spending will be up, another third say it will be about the same. Half of growers say energy spending will be about the same.

- Sixty percent of wholesalers, suppliers and importers expect to spend about the same on perishable products; 50 percent plan to spend about the same on hard goods. Forty percent said capital investment spending will be about the same. (Thirty percent said it will be down and 30 percent said they’re uncertain.) Forty percent said energy spending will be about the same and 30 percent say it will be down.

One spending area you’ve probably noticed is missing: Labor. The tricky business of finding qualified help and keeping it came up throughout the survey.

In 2016, 46 percent of retailers expect labor spending to be about the same. Similarly, 40 percent wholesalers, suppliers and importers expect labor costs to stay flat. But 71 percent of growers expect labor costs to rise.

Throughout the industry, one message resonated: This challenge is not going away.

“It’s difficulty to find people to hire,” lamented one Pennsylvania florist.

“The biggest challenge is to find good staff to support our continuing growth,” said a rep from a Colombian grower.

The nursery grower in California agreed. “We anticipate a shortage of production labor again this year,” she said.

Indeed, 49 percent of all respondents say they have had a difficult time attracting non-seasonal candidates for experienced design positions. Thirty-six percent say they’ve had a difficult time attracting non-season candidates for entry level positions in sales, processing and production.

Many industry members have no plans to add to staff in the short-term:

- Fifty-eight percent of retailers do not plan to add staff in the next six months; 27 percent said they’ll add part-timers only. A third of retailers say they do plan to increase salaries and/or pay in the next six months.

- Fifty-seven percent of growers have no plans to add more staff in the next six months (excluding seasonal/holiday). But 50 percent said they do plan to increase salaries and/or pay in the next 6 months.

- Forty percent of wholesalers, suppliers and importers said they will not add staff in the next six months. Thirty percent said they’ll add full-time staff only. Fifty percent said they have no plans to make changes to staff salaries or hours in the next six months.

In addition to worries over the economy and consumer spending, new minimum wage laws are behind at least part of the resistance to new hires for some respondents.

“Massachusetts has a new minimum wage law and a paid sic leave law that will cause me to be very cautious in regards to new hires,” said one Massachusetts retailer, adding that the prospect of higher salaries is a possibility. “Even though I don’t expect to raise compensation levels across the board, I will do so on a case-by-case basis if I feel it is warranted.”

The Year Ahead: Food for Thought

Even with challenges looming, many respondents expressed optimism for the coming year in anecdotal responses, particularly once the challenge of Valentine’s Day is out of the way.

“If we can get through without dropping more than 5 percent, we are in a good position to grow against last year’s weak numbers in the first two quarters,” said a Michigan florist.

A florist in Ohio predicted a 5 to 10 percent growth at her shop as a conservative estimate, based on the “last 12 months of trending.

Location certainly plays a role. A florist in Kentucky expressed excitement over a new location, and the potential for growth.

“It has been remarkable to see a difference in walk-in,” she said. “We have a completely different vibe in this location,” even though it’s situated near the previous site.

In Michigan, one florist celebrated the revival of corporate work in metro Detroit. Auto suppliers “are booming,” he said. “We had a number of corporate holiday party orders that we have not gotten since 2008.”

A New York florist noted his business is “trending more and more toward weddings, parties, corporate events and sympathy,” and away from everyday work. That’s okay with him. “Much better margins on this type of business, easier to buy and forecast needs for product and labor.”

And, for at least one florist in Florida, “2015 was the year we finally caught up to where we were when the recession hit in 2008.”

That’s good news, he said, and that’s why he’s not worried about a potential drop this year. After all, sometimes it’s impossible to read the tea leaves.

“Sales don’t always go up,” he said. “We may drop a bit in 2016, which is normal. Or, we may de better in 2016, which is also normal.”