Source: 2016 Spring Holidays Survey, emailed May 11 to SAF member retailers. 9 percent response rate.

Florists around the country are feeling pretty good about Mother’s Day 2016. Overall, sales were up for many, and average transactions were slightly higher than 2015 returns, according to the Society of American Florists’ post-holiday survey.

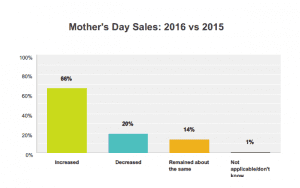

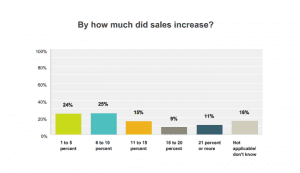

Sixty-six percent of florists who responded to the SAF survey reported an increase in sales. Among those respondents, nearly a quarter said the rise was modest, somewhere between 1 and 5 percent. About 37 percent of florists with those increased sales credited shop promotions for the uptick.

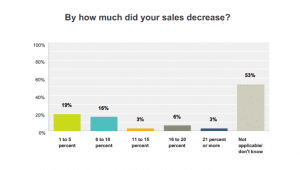

Meanwhile, 20 percent of respondents saw a drop in sales — 53 percent said they weren’t sure how steep the decline was — and 14 percent said sales were flat.

Those results indicate that the holiday was better than expected, with more florists experiencing an increase than predicted. According to the survey, only about 58 percent of respondents hoped to see an increase in sales. Seventeen percent predicted a drop and 28 percent said they were planning for flat sales.

Those numbers also show a continued upward sales trend. Last year, 60 percent of SAF survey respondents reported an increase (25 percent, flat; 15 percent, decrease) and in 2014, almost 53 percent saw sales rise (27 percent, flat; 20 percent, decrease).

Source: 2016 Spring Holidays Survey, emailed May 11 to SAF member retailers. 9 percent response rate.

Average transactions this year hovered just below $64, slightly higher than last year. (In 2014, the number was $60.)

The results are also complementary to predictions outside of the industry. Before the holiday, the National Retail Federation predicted Americans would spend an average of $172.22 this year, slightly less than last year’s record-high spending of $172.63. In total, spending is expected to reach $21.4 billion. (Final sales figures from NRF were not available at press time.)

At press time, SAF was still waiting on results from an American Floral Endowment Floral Tracking Study for insight into holiday spending from a consumer perspective. (Look for more coverage of that extensive study in upcoming issues of E-Brief and Floral Management.) Last year, a separate consumer survey, conducted for SAF by Ipsos Public Affairs, found that the average floral gift purchase for Mother’s Day in 2015 was just over $50, compared to $41 in 2014, for floral purchases made across platforms, including grocery stores, Internet floral providers, etc. When considering transactions only at retail florists, however, the Ipsos survey found average sales to be significantly higher, at $70, up from $63 in 2014.

Still, even florists who experienced uniformly positive results aren’t exactly popping champagne; they’re too busy eyeing unknowns in the immediate future (among them, new overtime rules, a less-than-stellar jobs report released in early June and a presidential election that has just about everyone expecting the unexpected)

Source: 2016 Spring Holidays Survey, emailed May 11 to SAF member retailers. 9 percent response rate.

Sales by Business Size

Size seemed to matter on Mother’s Day, with larger florists experiencing better results.

Among businesses with less than $300,000 in annual sales, 63 percent reported a sales increase (15 percent, decrease; 18 percent, flat). Fifty-four percent of businesses with $300,000 to $499,999 in annual sales saw an increase (30 percent, decrease; 17 percent, flat).

Meanwhile, 72 percent of businesses with $500,000 to $999,999 in annual sales saw an uptick (26 percent, decrease; 2 percent, flat) and 76 percent of businesses with $1 million or more in annual sales saw a sales increase (10 percent, decrease, 15 percent, flat).

Factors Behind Holiday Sales

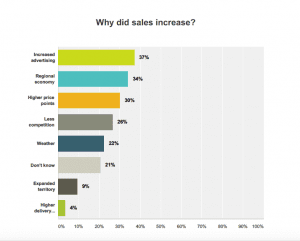

Florists who experienced increased sales appear to have taken a proactive position on the holiday. In addition to the 37 percent who credited increased shop advertising and promotions for their higher sales, for instance, 30 percent said they benefited from higher price points, 9 percent noted expanded territory or a new location and about 4 percent said they were aided by higher delivery charges.

Source: 2016 Spring Holidays Survey, emailed May 11 to SAF member retailers. 9 percent response rate.

Luck and timing also came into play: 34 percent said they were helped by the regional economy, 27 percent credited the advantage of fewer flower shops in their local areas and 22 percent said favorable weather was a positive factor.

A “good selection of price points and products” helped attract more people to one shop in Minnesota. “It was a great holiday for us,” wrote the respondent. “The gift side of our shop also did very well.”

“Advertising is key to this holiday,” noted one respondent from Connecticut, adding that, particularly online, ads can help consumers differentiate local florists from out-of-town competitors. “Local merchants must educate the customers and recipients.” (Read more about how advertising online can help you protect your brand in the June issue of Floral Management.)

In Florida, a respondent said staff training and advanced prep, in the form of a sales script to support staff, led to a $15 increase in average sales.

“Customers responded well,” she said. “We are going to continue this practice.”

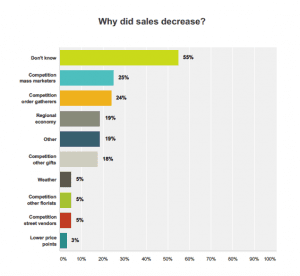

Among those who saw a sales decrease, 25 percent blamed competition from mass marketers/supermarkets and 24 percent blamed order-gatherers. About 19 percent said they faulted the regional economy and 18 percent said they were challenged by competition from other gifts (non-floral vendors). Only 5 percent (each) blamed the weather, competition from other florists and competition from street vendors. Three percent said lower price points held them back.

Source: 2016 Spring Holidays Survey, emailed May 11 to SAF member retailers. 9 percent response rate.

Echoing the sentiments of a number of florists in write-in responses, the florist in Georgia expressed disappointment in wire orders with a “value too low for us to make a profit,” along with aggressive competition from national order-gatherers and a general reluctance on the public’s behalf to buy flowers.

“Grocery stores that sell flowers for cost certainly don’t help,” she said. “There is a major convenience factor, too, in those cases.” (The respondent may well be onto something important there: SAF’s 2016 Generations of Flowers Study found convenience to be a major motivating factor, particularly for Gen X members.)

With regards to the question of wire order transactions, Jeff Bennett, president of Teleflora, said the holiday was a “tremendous success,” with florist-to-florist order volume up “significantly” and eFlorist orders per shop up 16 percent over last year.

“We also continue to see holiday-over-holiday growth in average order value, with Mother’s Day showing 5 percent growth in orders over $65 and a 2 percent decline in orders under $45,” he said.

As a public company, 1-800-Flowers.com “cannot share sales results from the holiday,” said Yanique Woodall, a vice president. Emily Bucholz, director of marketing, communications and events at FTD, said the company cannot release results ahead of its Q2 earnings call later this summer.

Cut Flowers: Mother’s Day Staple

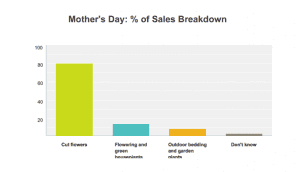

On average, 79 percent of Mother’s Day sales were cut flowers, a slight drop from last year’s reported 83 percent.

Fourteen percent of sales were flowering and green houseplants (12 percent in 2015) and 8 percent were outdoor bedding and garden plants (comparable to last year’s 7 percent).

A number of respondents noted that a soggy, cool — and in some areas, downright chilly —April and May hurt garden center sales on Mother’s Day and during the overall spring season.

Source: 2016 Spring Holidays Survey, emailed May 11 to SAF member retailers. 9 percent response rate.

“A cold, rainy weekend did not hurt florist business; however, it affected our garden center,” wrote a florist in Colorado.

Weather conditions in key flower-growing areas, including Colombia and California, affected flower supply this year and the overall market was very tight, according to a number of wholesalers, who pointed to shortages in key flower areas, including carnations and roses. Read more about their perspective and that tight market.

Open for Business?

The downside of brisk business? Too much volume, which led to order cut-offs (and, potentially, disappointed customers who went elsewhere for gifts).

While 48 percent of respondents said they never stopped accepting orders, 22 percent did so Friday, 16 percent cut off orders on Sunday and 5 percent did so on Friday. (The remaining 9 percent indicated “other” in their response.)

In addition, 35 percent of respondents said they never suspended incoming orders. Among those who did, 22 suspended orders on Friday, 21 percent did so on Saturday and 8 percent did so Sunday.

Staying open seems to have led to better returns: Among those who never cut off any orders, 58 percent reported a sales increase (26 percent, decrease; 17 percent, flat).