Source: Fall Holidays and Pre-Holiday Gut Check Survey. Emailed Nov. 28. 11.4 percent response rate.

Haul out the holly. Fill up the stockings. Christmas 2017 is shaping up to deliver cheerful returns to retail florists.

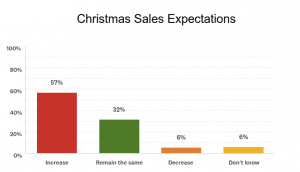

That’s the pre-holiday read according to a recent Society of American Florists member survey, which found that about 57 percent of respondents expect increased Christmas sales this year. Roughly 32 percent are planning for sales that track closely to 2016 returns, and only about 6 percent are planning for a decrease.

Larger businesses are even more optimistic: 63 percent of respondents with $50,000 to $999,999 in annual sales say they are planning for an uptick, and 65 percent of respondents with $1 million-plus in annual sales are expecting higher returns. Results across geographic areas were fairly consistent.

This time last year, SAF members were feeling slightly less sure of Christmas returns — almost half of respondents to the 2016 pre-Christmas survey said they were planning for higher sales. (Those instincts proved spot-on: About 46 percent of respondents to a post-holiday survey reported higher sales.)

Meanwhile, the National Retail Federation expects holiday retail sales to increase between 3.6 and 4 percent for a total of $678.75 billion to $682 billion, up from $655.8 billion last year.

Christmas Promo Plans

Respondents are working on many (many) promotion ideas for the year’s holiday, including social media ads, SEO optimization, free gifts with purchases, open houses, hands-on workshops, charity or community events and partnerships, and signage galore.

One florist in Arizona said she’s focusing more this year on home holiday installations, along with “custom wreath/garland décor” after realizing no one in her town was offering those services.

A florist in Nova Scotia said he’s been grabbing customers’ attention since September with designs that prominently feature pine, fir and cedar—accents he’s promoting as “winter foliage.”

In Connecticut, one shop is promoting small potted outdoor spruce trees, decorated or un-decorated. “The planting of the trees in the spring is a great sales pitch,” that florist explained.

In Michigan, mild weather has led to strong sales of fresh outdoor product. “The consumer is ready to spend more this holiday,” said one florist in that state.

The survey also found that November is crunch time for prepping for Christmas in-store. About 47 percent of respondents put out Christmas displays in November, before Thanksgiving, and 26 percent put out Christmas displays after Thanksgiving. Roughly 21 percent deck their halls in October, while 3 percent are rocking around Christmas trees as early as September.

While many florists said they’re happy to delay Christmas décor in-store (and that customers appreciate the fact that smaller businesses don’t rush through fall holidays as big box competitors might), at least one Arizona florist said she was happily pushing Christmas months ago.

“This year we put our holiday merchandise out in September,” she wrote. “Everything that lights up, we have batteries in and have them lit which makes them sell. I got tired of being the last business to put out Christmas so this year I went early and have seen sales up already.”

The survey also queried members on fall holiday returns. Among the findings:

Source: Fall Holidays and Pre-Holiday Gut Check Survey. Emailed Nov. 28. 11.4 percent response rate.

HALLOWEEN

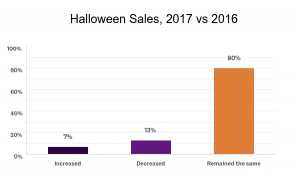

Halloween continues to be hit or miss for many florists. Plenty of respondents said it’s a non-floral event, although others noted lighthearted promos, designs and events that delighted customers.

About 62 percent of respondents did not promote Halloween; 80 percent said Halloween sales were on par with 2016 results. Sixty-five percent of respondents said Halloween themed/colored fresh flowers were the bestselling item for the holiday. About 11 percent of respondents hosted a Halloween event — about 29 percent offered Halloween specials.

Costume-themed promos proved popular. One florist in Indiana posted pictures on Facebook of costumed customers. “We had 702 reach ,” he wrote. “Not an exceptionally high reach, but still good.”

In Virginia, a florist hosted a costume contest for kids and handed out candy throughout the day. “We had a photo op for the kids to get up in Halloween window,” she explained, adding that the outreach was more about building goodwill and future sales. “Parents really love that as the that nice florist that had the photos.”

In Minnesota, a florist blended fall and Halloween-themed designs, with good results. “We want to feature fall florals which can easily work for a Halloween party with some fun additions,” the respondent noted.

Likewise, in Alabama, another florist used a ceramic pumpkin for permanent and fresh designs. “The pumpkin was a great fall décor item that can be used as a candy or cookie dish,” the respondent noted, a fact they played up with customers

Source: Fall Holidays and Pre-Holiday Gut Check Survey. Emailed Nov. 28. 11.4 percent response rate.

THANKSGIVING, BLACK FRIDAY, SMALL BUSINESS SATURDAY AND CYBER MONDAY

Thanksgiving sales this year were steady for about 40 percent of respondents. About 35 percent saw an increase and 24 percent saw a drop. A number of respondents noted that cash-and-carry bouquets and pre-made designs sold particularly well — with customers ducking in quickly to pick up hostess gifts or last-minute centerpieces.

Still, several florists, including one shop in Wisconsin noticed an increase in custom orders for Thanksgiving. “We got more orders for custom centerpieces this year than we have in the past couple years,” that respondent noted. “That’s a good sign.”

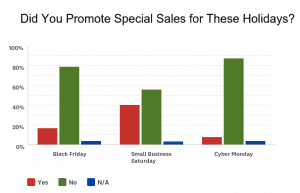

The shopping days that follow Thanksgiving were not floral holiday powerhouses, a trend that’s consistent with the recent past. Overall 79 percent of respondents did not promote special sales for Black Friday and 88 percent said they didn’t promote them for Cyber Monday. About 56 percent of respondents did not promote Small Business Saturday sales.

Roughly 47 percent of respondents said Black Friday sales were about the same as 2016 results. About 21 percent said those sales dropped and about 10 percent said they increased—remaining respondents said the event isn’t applicable to their shops or they don’t know returns. Several respondents noted they use the day to transition to Christmas, closing the business to focus on décor jobs or transitioning retail areas fully to Christmas displays.

About 38 percent of respondents said Small Business Saturday was about the same as last year, in terms of sales. About 21 percent said they experienced an increase and almost 18 percent saw a drop-off. (The remaining respondents said the event isn’t applicable to their store or they weren’t sure of results.)

Partnerships, with other businesses and civic groups, were popular promo vehicles for the day. A number of respondents said they use Small Business Saturday to show appreciation for their customers, through events and special discounts. One florist in Louisiana used the holiday to engage in a community pop-up store, an effort that helped generate coverage from her local media. A florist in Pennsylvania participated in a community Cupcake Crawl. “We were decorated for Christmas and sold a lot of merchandise” through the event, she said.

Less than 4 percent of respondents said online sales increased on Cyber Monday. About 12 percent said those sales decreased compared to last year and 46 percent said they were the same. About 38 percent said they weren’t sure of returns or that the event isn’t applicable.

According to the National Retail Federation, more than 174 million Americans shopped in stores and online during the holiday weekend. Average spending per person over the five-day period was $335.47, with $250.78 — 75 percent — specifically going toward gifts. The biggest spenders were older Millennials (25-34 years old) at $419.52.

The most popular day for in-store shopping, according to NRF, was Black Friday, cited by 77 million consumers, followed by Small Business Saturday with 55 million consumers. The top two days that consumers shopped online were Cyber Monday with more than 81 million and Black Friday with more than 66 million. In addition, 63 percent of smartphone owners used their mobile devices to make holiday decisions, and 29 percent used their phones to make actual purchases.