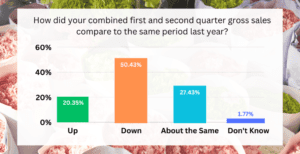

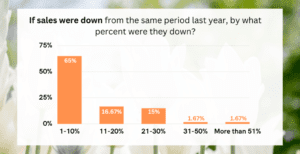

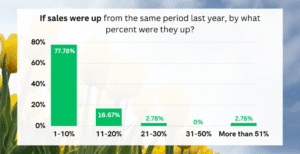

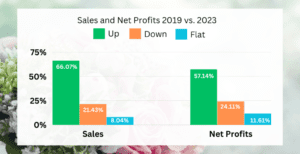

Sales and units sold were down in the first two quarters of the year compared to the same time last year, but up compared to 2019 sales, according to SAF’s biannual economic outlook survey.

First, the good news: Compared to 2019, sales, units sold and profitability were up in the first two quarters of 2023 for the majority of floral businesses that responded to the Society of American Florists’ biannual economic outlook survey.

But now, the not-so-good news: Compared to the first two quarters of last year, sales and units sold were down but order value was up for the majority of floral businesses that responded to the survey.

Those comparisons bring into sharp focus the growth and interest in plants and flowers that the floral industry experienced during the pandemic — but also reveal a slip in some of that traction. The survey, sent July 5 to retailers, growers, wholesalers, importers and suppliers, also found that about half of the respondents believe they’ll end the year down from 2022 sales.

Those findings come as fears continue to linger about the possibility of a recession despite a resilient job market, increasing wages, decreasing rates of inflation and a rebounding housing market.

“In spite of the good economic reports, I’m still forecasting that late this year or early next year we’ll have a very short-lived recession — a mild recession — and then we’ll see the federal reserve lower rates and that will spur economic activity,” said Charlie Hall, Ph.D., the Ellison Chair of Floriculture at Texas A&M University and SAF’s chief economist, during SAF’s June Ultimate Roundtable. “And hopefully we can spin out of the downturn very quickly.”

For now, consumers are still holding onto government COVID-19 relief money, have experienced an increase in wages, and continue to spend, Hall said.

“That’s a recipe for buying flowers if ever I heard one,” he said. “So why is it so hard to sell flowers? I’m not sure we moved the needle that much in that flowers are a necessity rather than a luxury. We need to keep pushing and keep pushing and keep pushing.”

Source: Economic Outlook Survey, July 2023.

Order Value Up

Higher pricing due to the increased costs of goods, wages and energy costs, as well as strategic business changes, contributed to a higher average order value for 65 percent of respondents.

“We increased our minimum to do a delivery, increased our delivery fee slightly and started trying to increase add-ons,” Jolene Powell of Floral Expressions with Jolene in Elkton, Virginia wrote in comments explaining the business’s increase in order value.

Scott McNeill, of Flowerland in Bartlesville, Oklahoma pointed out that while order value is up, profit is not. “Cost of goods has drastically increased, so making the same or less profit,” he said.

Another florist reported that its average sale value is starting to decrease, something 12 percent of respondents also reported. “Our average sale definitely increased post Covid when costs increased so much but now that the economy seems unsure, our average sale is beginning to decrease,” said Brenda Sterk of Eastern Floral in Grand Rapids, Michigan.

Units Down

The majority — 56 percent — of florists have seen units sold drop in the first two quarters of the year, the survey found. Twenty-five percent indicated units were about the same, and 14 percent reported an increase.

“We saw a small amount of decrease in the number of people sending flowers, especially at the holidays, although those that did send seemed to be spending more,” noted Cathy Herrold of Graci’s Flowers and Gifts in Selinsgrove, Pennsylvania.

Compared to 2019 sales, units were up for 59 percent of respondents, down for 26 percent, and the same for 7 percent.

Staying Strong

Florists are making strategic decisions to control costs and protect their profit margin, including cutting employee hours or switching to contractors, buying less inventory or less expensive inventory, redesigning recipes with lower cost products, and shopping around more for the best prices.

“During the pandemic, we were sort of ‘hoarding’ vases and containers because they were so hard to get,” says Brian Kusuda of Jimmy’s Flower Shop in Ogden, Utah and a member of SAF’s board of directors. “Now, instead of tying money up in inventory, we are lowering the inventory levels. We are also being much more conservative on the number of fresh cut flowers that we are bringing in daily. Controlling our waste is a big factor.”

Asked what they’re doing to market products in an uncertain economy, many respondents noted that they are heavily marketing on the internet and through social media — and luring customers to the store with specials and events.

“We are putting more efforts into our social media platforms because in general, they are free and people love to see pictures of beautiful flowers,” wrote Kusuda. Jimmy’s is also offering discounts on roses and other flowers that are less expensive to buy in the summer, he said.

Others are looking to connect with customers through design classes and offering (and advertising) products at every price point. And at least one floral business, Oregon Flowers in Aurora, Oregon, is heeding the advice of the Floral Marketing Fund’s new report that indicated floral consumers prefer to purchase sustainably grown flowers.

“We are promoting that we grow a carbon sequestering product,” wrote vice president Tyler Meskers.

Amanda Jedlinsky is the managing editor of SAF NOW.