During her “State of the Industry — and SAF” address last week, Kate Penn, SAF’s CEO, laid out the challenges the industry faces and how SAF is evolving to better meet the needs of floral professionals.

Labor, rising costs, intense competition and the need to understand and adopt new technologies are among the most significant challenges facing floral professionals today — and industry members, now more than ever, need targeted support to overcome these challenges and continue to grow and thrive.

That was the message Kate Penn, CEO of the Society of American Florists, delivered last week during “State of the Industry — and SAF,” the kick-off presentation during SAF Amelia Island 2019, the association’s 135th annual convention. During her remarks, Penn charted some of the unprecedented changes in the industry and the broader retail environment over the past decade — and the implications of those shifts on the industry — and she shared insight on how SAF is evolving to better meet the needs of forward-thinking floral professionals.

Audience members react to the question, “How’s business?” during Penn’s address.

Consolidation, Stabilization — and Growth?

Penn began her address by providing the audience with a snapshot of the floral industry as it stands today.

She shared, for example, that 52 percent of respondents to an SAF economic survey from last summer said sales for the first and second quarters of 2019 were up, as compared to the same quarters in 2018. Most respondents expressed optimism about the future — 47 percent of respondents said they are “optimistic” about sales this year, and another 15 percent categorized themselves as “very optimistic”— with the wholesale segment being the most optimistic segment.

Penn also turned her attention to industry growth patterns, and more specifically stabilization and consolidation, noting that, using the best data available, including feedback from individual businesses, the number of importers has stayed relatively stable. The domestic grower segment also is relatively flat — though there have been some shifts in production among states.

Meanwhile, the number of wholesale doors has decreased, but the drop-off has not been as steep as previously predicted, due to there being more consolidations versus closings, with an estimated 500 wholesale doors in operation today, compared to 560 three years ago.

As for retail, “we can’t really talk about what’s happening at the retail segment without acknowledging that how the consumer buys flowers — and just about everything else — bears little resemblance to what that process looked like a decade ago,” said Penn, pointing to examples such as Instagram and Amazon as platforms that were much less widely used — or nonexistent — a decade ago. “Those changes have given birth to enterprising disruptors, seismic shifts in the chain of distribution, and consolidation in the supply chain.”

Among the examples of those “seismic shifts”: online buying, mobile purchasing, millennial purchasing preferences, new industry disruptors and direct-to-consumer platforms, a growing number of studio florists, and more.

“Amidst all of this, and, some might argue because of it, the number of retail flower shops has dropped 40 percent, from just over 20,000 in 2006 to just shy of 13,000 in 2017,” Penn said. “It’s pretty dramatic.

But there’s good news: There are signs that the overall rate of decline in the number of flower shops is stabilizing.”

Indeed, Penn said SAF is projecting that the annual decline in retail shops between 2019 and 2023 will be about 1.7 percent, compared to 5.4 percent from 2006 to 2012 and 2 percent from 2013 to 2017.

More good news? Penn said total U.S. spending on flowers is expected to grow to $44.4 billion by 2023, compared to $35.2 billion in 2017.

“The consumer continues to enjoy our industry’s product – whether buying for themselves for others,” Penn said. “So, there are some really good things happening.”

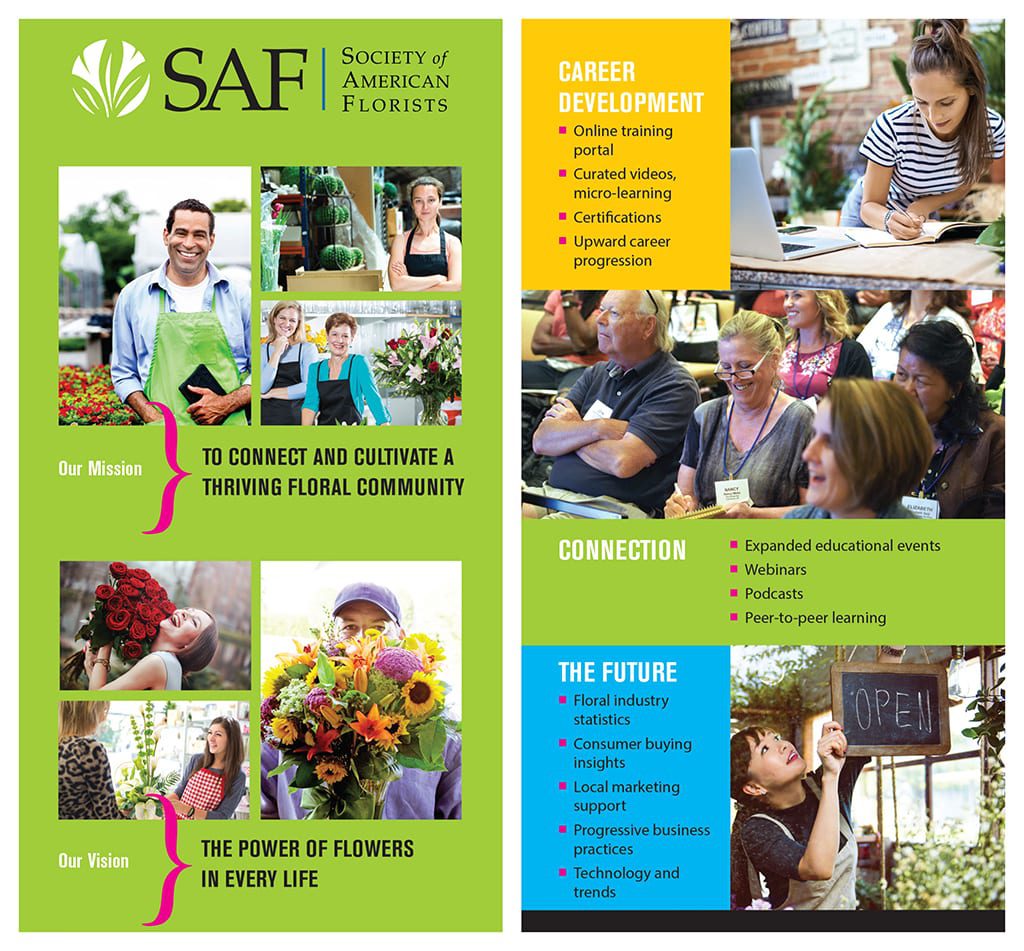

SAF’s new strategic plan, the result of a one-year, comprehensive effort that drew on the input of SAF staff, members and nonmembers, and expertise from a third party, was revealed last week during SAF Amelia Island 2019.

Challenges Facing the Industry

Penn spent a portion of her address detailing the major challenges floral professionals face — drawing on SAF and third-party surveys, along with extensive conversations with association members and nonmembers.

Highlights include:

Labor

Labor issues cut across industry segments. “For growers, the lack of immigration reform is a barrier to additional growth. There are crops not being planted, not being harvested,” Penn said. “Retailers and wholesalers are struggling to find help at all levels – entry level as well as mid-level managers.”

She also pointed to the trucking industry, which is “experiencing a labor crisis” and a current shortage of 60,800 drivers, up 20 percent from 2017.

Penn also said that floral professionals are struggling with how to recruit and retain talent and how to develop career paths.

“One retailer perfectly sums up why, ultimately, the labor piece is so critical,” she said. “’A good hire that is committed to our company and to our customers is more important than ever – because customers are more demanding than ever, they have greater expectations on how they should be treated and serviced.’”

Costs

Penn outlined a long list of rising costs with which industry members are contending, including health insurance, air freight, tariffs, distribution costs, minimum wage. The challenge, as one retailer related to Penn recently: “How do we not price ourselves out of business?”

Competition

“Increasing sales in an intensely competitive environment is a top concern for many in our industry,” Penn acknowledged. “Amidst so much change in consumer buying habits, evolving your business model to stay relevant is a big challenge.”

One of those changes to which business owners are having to adapt: consumers’ “just-in-time” mindsets, driven by Amazon and its Prime speedy delivery. Penn said that direct-to-consumer floral companies have also “altered how people think about what flowers look like,” and an increase in studio and event-only florists has created new opportunities for some wholesalers, and new competition for retailers. In addition, she added, there is the ongoing competition from non-floral brands.

Technology

The list of new and updated technologies that floral industry professionals have to not only be aware of, but also master can seem daunting: SEO, POS, social media, robotics, automation, AI. The list goes on. “The pace of technological changes and what it means to the consumer and your business,” Penn said. “It’s challenging to keep up with.”

SAF will redirect its SAF PR Fund dollars from national to local marketing support, to “help drive local sales and shape your customers’ appreciation and need for flowers,” SAF CEO Kate Penn said. SAF will also enhance its content for the benefit of floral professionals.

New Opportunities — and a New SAF

Side-by-side with all of these challenges stand opportunities for growth, insisted Penn, who presented examples of retailers thriving in the new “experience economy” and capitalizing on consumers’ desire to connect authentically in person with local businesses, not to mention millennials’ abiding love of nature and, in particular, houseplants.

“Consumer preferences are evolving, and competition is stiff, so the opportunity lies in what your competition isn’t doing that you can do,” Penn said. “It’s there for entrepreneurs who can re-imagine their business as the designer and curator of experiences. It’s there for businesses who tell the story behind their product — who designed it, who grew it. It’s there for marketers who partner with influencers and leverage social media to drive customer interest. It’s there for businesses that leverage technology to raise their online brand profile.”

Over the past year, SAF has done a deep dive into all of these challenges and opportunities, she explained. With the help of a third party, the 135-year-old association has created a new strategic plan, one that allows the group to reinvest in longstanding high-need areas, including education, local marketing and government advocacy, and provide additional solutions to challenges facing the industry.

Some highlights from that new plan:

Advocacy. “We know we’re already on the right track with some of our work: Moving forward, we will double down on our advocacy work — fighting for immigration reform and advocating for a minimum wage that’s not going to put small businesses out of business,” Penn said.” Protecting your interests in Washington directly or indirectly addresses rising costs, keeping a stable workforce. We will continue to do this.”

Talent. “We know a well-trained employee is a happy and productive employee,” Penn said. “Study after study shows a direct correlation between training and employee retention: According to LinkedIn’s 2018 Workforce Learning Report, 93 percent of employees would stay at a company longer if it invested in their careers.” A major challenge? “It’s hard to find the time for training,” she said.

That’s why SAF is working to create a platform for training and education where all types of individuals can connect to gain education, search knowledge bases, share experiences, earn certificates and track progress.

“This portal will not only attract existing professionals but also students and aspiring floriculture professionals,” she added. “We could create a pool of entry level employee prospects, and at the same time a source for growth, training and career development. And in doing so, we bring a sense of pride and upward career progression to the industry and your business. And help you retain employees by fostering a strong, healthy work culture.”

Events. Penn said the new strategic plan continues SAF’s emphasis on in-person, live events, including the group’s annual convention and 1-Day Profit Blast series, along with other more niche events and those geared toward specific groups, including the industry’s next generation.

“Great things happen when our industry gets together,” Penn said. “When you can talk to your peers in your own segment but even more important, when you can talk to your customers, your suppliers…SAF is the only place where the entire industry can come to meet. We will continue to leverage our role as the industry’s connector and expand our existing educational events.”

Competition. While acknowledging that SAF cannot as a trade association get rid of competition, Penn said the group will “double down on our efforts to help you compete, and in doing so, prepare for a thriving future.”

Step No. 1 in that plan? SAF will redirect its SAF PR Fund dollars from national to local marketing support, to “help you drive local sales and shape your customers’ appreciation and need for flowers,” Penn said. She added that the group will also be enhancing its content on myriad fronts — on topics such as evolving customer preferences, knowledge about sales and production trends, best practices for engaging a multigenerational workforce, technology, and more — for the benefit of floral professionals.

“SAF will be leveraging the most convenient and progressive delivery for getting you the data and knowledge you need to adapt your business model so you can have a successful future,” Penn said. “And we will leverage partnerships to make this happen, because we favor community over competition. We can do more working with each other than we can alone. We know there is strength in unity.”

Finally, Penn unveiled the association’s new mission — “to connect and cultivate a thriving floral community”— and vision — “the power of flowers in every life.”

“We know an outstanding flower buying experience is powerful – powerful for the consumer, because it immediately transforms their moment, their day, their life, and powerful for our industry: because it creates a habit, loyalty, a flower fan,” Penn said, closing her address. “And, for , a beautiful, fruitful career and business.”

If you missed Penn’s address in person, you can watch it in full and find out more about SAF’s new plan.

Penn and SAF President Chris Drummond, AAF, PFCI, will also field questions about the new plan live on Facebook on Thursday, Sept. 26, at 3 p.m. EST.

Look for more coverage in the November-December issue of Floral Management.

Mary Westbrook is the editor in chief of Floral Management.