Pointing to SAF member data collected after Valentine’s Day and Mother’s Day this year, Floral industry financial analyst Charlie Hall, Ph.D., noted “both holidays were pretty good — and that’s good news for florists.”

Can the U.S. economy finally get to 3 percent growth under the Trump administration — and is that target even a worthy goal?

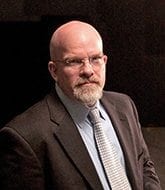

Floral industry financial analyst Charlie Hall, Ph.D., recently tackled those questions (and much more) during “The Economic Effects of Trumponomics,” a policy-focused, decidedly nonpartisan, free webinar for Society of American Florists members. During the 30-minute session, Hall presented detailed analysis of the current economy and risk of future recession.

“We are still in recovery, and the rate of recovery is slower than it has been historically,” said Hall, a professor and Ellison Chair in the Department of Horticultural Sciences at Texas A&M University. “But here are some silver linings.”

Pointing to SAF member data collected after Valentine’s Day and Mother’s Day this year, Hall noted that “both holidays were pretty good — and that’s good news for florists.”

Still, the overall economy faces one major (and, in Hall’s opinion, very predictable) hurdle: Gen X, people ages 37 to 52, is the demographic currently in its most productive earning years, but it’s also a much smaller generation than boomers or millennials.

“Mathematics are a major headwind in growth of GDP,” he said, noting that President Trump and Mick Mulvaney, director of the Office of Management and Budget, aren’t alone in setting a goal of 3 percent growth — the Obama administration had similar ambitions. “We’re basically a plow horse economy growing at 2 percent because of demographics. Some politicians seem surprised that we can’t arrive at 3 or 4 percentage growth points, but they shouldn’t be.”

Given the country’s demographics, it would take a tremendous effort — and maybe even some magic — to get to 3 percent, he explained.

“The first thing that would have to happen is that we’d have to have 30-40 million more workers,” he said, adding that, to gain that many new workers, older Americans would need to work an additional decade and all adults would need to be employed; even then, a gap would exist. “We don’t need to talk about walls. We need to start chartering buses. , every business in America would need to invest like they did in the 1990s, and we’d need to increase the productivity of current workface, much like we saw in the 1960s.”

Hall’s point? The 3 percent goal may be an unnecessary distraction from an economy that, overall, is “stable.”

As for the $1 million question that Hall fields all the time as an economist: He doesn’t think we’re very likely to head into a recession in the next year. In fact, he said thinks there’s just a 15 percent chance of that happening. He added, however, that industry members would be smart to start planning for the next downturn soon.

“On average, we have a recession every 6.5 years, so we’re already pushing it,” he said. “The retail florists and wholesale florists who exited the industry during the Great Recession did so not because they didn’t have quality designs or product, they did so because they were ill-prepared. So, start developing plans. Have a plan in place for the investments you make and when you expect them to pay off. Have a plan for your financial strategies.”

Listen to the whole session, including Hall’s responses to member questions about new minimum wage laws in Washington and California and what international variables, including hostile relations with North Korea, could mean for the U.S. economy.