This year’s survey was mailed to SAF members on July 20 and had a response rate of 6.8 percent. The survey includes insights from SAF members across segments.

Floral pros who weighed in on a Society of American Florists’ economic survey indicated they feel pretty good about sales in the first and second quarter of 2019 — along with the prospect of returns still to come in the remaining months of the year.

Forty-seven percent of respondents to the SAF survey said they are “optimistic” about sales this year and another 15 percent categorized themselves as “very optimistic.” Nearly 30 percent are more cautious, calling themselves “neutral” or “uncertain.” About 8 percent said they are “pessimistic.” Remaining respondents, less than 1 percent, are “very pessimistic.”

Retailer respondents reported an average transaction of slightly more than $74 — an increase from last year’s $66.

This year’s survey was mailed to SAF members on July 20 and had a response rate of 6.8 percent. The survey includes insights from SAF members across segments.

Other highlights from the survey:

Sunny Sales Outlook

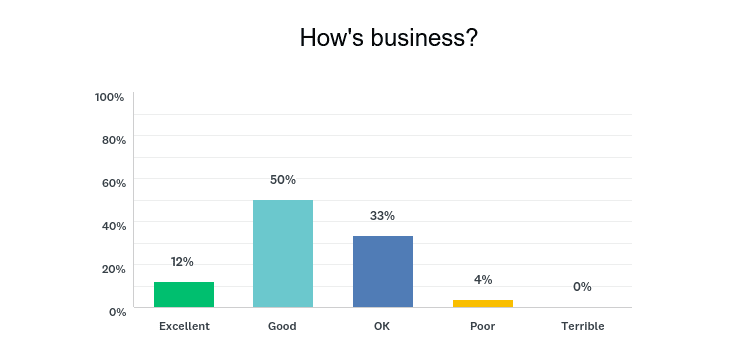

About 50 percent of respondents said business is “good”— another 12 percent classified it as “excellent.” Meanwhile, about 33 percent said business is “OK.” The rest of respondents, around 5 percent, said business is either “poor” or “terrible.”

Those results are similar to returns from the same time last year, when 48 percent of respondents to an SAF survey said business at that time was “good.”

Looking at the responses this year by segments:

- 61 percent of growers classified business as “good”; 17 percent called it “excellent.”

- 53 percent of wholesalers, suppliers and importers called business “good”; 16 percent called it “excellent.

- 49 percent of retailers said business is “good”; 12 percent, “excellent.”

About 52 percent of respondents to the survey said gross sales combined from the first and second quarter were up this year, compared to the same period last year; another 30 percent said they were “about the same.”

Among those who said gross sales were down, 62 percent said the decrease was by no more than 10 percent.

Among those who saw gross sales increase, 71 percent said the uptick was between 1 percent and 10 percent. (Questions related to net profits yielded similar results.)

Spending Predictions: Labor Continues to Challenge

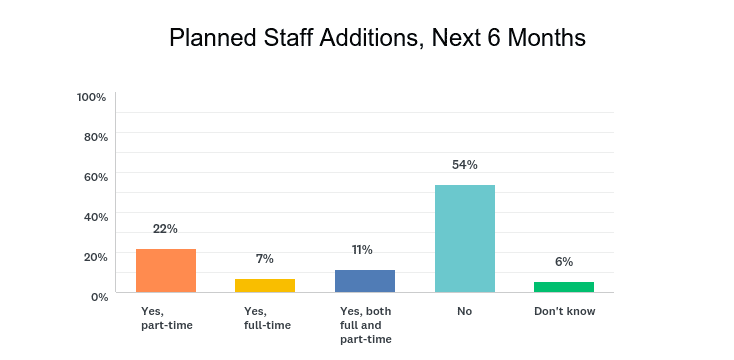

The survey also delved into spending predictions and found that 49 percent of respondents expect to spend more on labor this year — even though 54 percent of respondents have no plans to add more staff in the next six months.

The survey also delved into spending predictions and found that 49 percent of respondents expect to spend more on labor this year — even though 54 percent of respondents have no plans to add more staff in the next six months.

Other spending-related findings:

- Perishable products: 41 percent of respondents predict their spending in this category will be higher this year; 37 percent said it will likely be about the same.

- Hard goods: 37 percent of respondents predict spending in this segment will be about equal to last year; 34 percent are planning for an increase.

- Giftware: Respondents were fairly evenly divided in this area, with 21 percent predicting an increase, 26 percent planning for decreased spending and 30 percent expecting to spend about the same in 2019 as 2018.

- Capital Investments: About 36 percent of respondents said they’ll likely spend about the same this year; a quarter are planning to increase their spending.

- Energy: More than half of respondents (53 percent) predicted energy costs will be about the same this year — about a third said they think they’ll spend more.

Labor continues to be a major challenge with which industry members wrestle. Forty-five percent of respondents agree with the statement “we have a difficult time attracting non-seasonal candidates for experienced design positions.”

Last year, about 51 percent of respondents agreed with the same statement.

In addition, 41 percent of respondents to this year’s survey said they have no plans to make changes to pay, schedules, benefits or staffing levels in the next six months.

National Issues

About 52 percent of respondents said they expect health care costs to have an effect on business this year; 40 percent said the same thing about tax reform, and 19 percent said immigration reform will have an effect.

Write-in responses to this section of the survey showed the breadth of issues with which many in the industry are dealing.

“ start by affecting the growers the most, then the wholesales, and then the retailers. It affects the entire industry and is a real concern,” wrote one retailer in the Midwest. “Our two biggest concerns are immigration reform and the push for increased minimum wage.”

“For immigration, I worry about escalating prices from growers from lack of workers,” wrote a retailer/grower in the West. “For health care, I worry that my managerial staff will need better benefits and leave for corporate type jobs.”

“The new tax laws actually helped my business and it allowed me to add money into the company 401K program,” noted one retailer in Texas.

A retailer in the Northeast had a different experience. “Tax reform not significant enough,” wrote the respondent. “Small businesses are still faced with a myriad of tax issues. With immigration reform: Who will do the work that the immigrants were doing? health care is still unaffordable for many including operators of small businesses.”

Look for more coverage of the survey in an upcoming issue of Floral Management.

Mary Westbrook is the editor in chief of Floral Management.