Source: 2016 Second Quarter Economic Outloook Survey, emailed July 10 to SAF members 8 percent response rate.

So far, business in 2016 has been pretty good, and, halfway through the year, many floral industry members are planning for a strong finish.

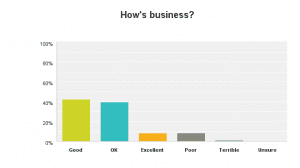

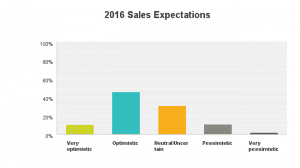

Forty-six percent of respondents to the Society of American Florists’ Second Quarter Economic Outlook Survey said they are “optimistic” about sales expectations this year. About 42 percent of respondents classified business as “good.”

Two hundred twenty-nine SAF members from across three segments — growers, wholesalers and retailers — responded to the survey.

The positive results don’t erase real challenges floral industry members face on myriad fronts, including daily struggles of managing a small business and the work of surviving against stiff competition, along with worries about the economy, escalating costs, environmental factors such as the California drought, and the looming presidential election, which has generated uncertainty for business owners and consumers.

“The economy is improving, business is improving,” noted one bullish wholesaler in Missouri.

That optimism, however, wasn’t universal: “ election year, terrible choices, circus environment, all leads to uncertainty,” worried one California wholesaler. “We are in the beginning stages of a recession.”

In fact, factors outside the direct control of any single business owner (the economy, unemployment, exchange rates and more) seem to weigh heavily on some industry members.

“We still have high unemployment in our area,” explained a florist in Ohio. “Our senior customers spend money, but carefully.”

Indeed, the economic picture changed dramatically depending on where a business is located. For instance, a florist in Wyoming admitted to being down 12 percent “due to the oil field crisis in our region. Many jobs have been lost so people are spending less and moving away.”

A Pennsylvania retailer, articulating a challenge many florists seem to be facing, said uncertainty itself was the biggest threat.

“Business is up one month and down the next,” the florist wrote. “It is hard to get a grasp of where it will go in the second half of the year. All the uncertainty in the world may make customers more cautious.”

Source: 2016 Second Quarter Economic Outloook Survey, emailed July 10 to SAF members 8 percent response rate.

A florist in California sounded a similar note of caution: “The economy in my area is stable, but slow growing. My business is doing well because so many florists have closed in my area, as well as grocery stores. I don’t have any real big concerns for 2016… 2017 may be another subject.”

Growers Among the Most Positive

In addition to the 42 percent of respondents who said business is “good,” almost 40 percent of total respondents classified it as “OK”; about 8 percent rated it either “excellent” or “poor.” (Good news no matter how you slice it: Less than 1 percent said business is “terrible.”)

Looking at those responses by segment, growers seem to be the most positive:

- 50 percent of growers said business is “good”; 38 percent said “OK”; 12.5 percent said “excellent.”

- 43 percent of retailers said business is “good”; 39 percent said “OK”; 9 percent said i “poor”; 9 percent said “excellent.” Less than 1 percent said “terrible.”

- 57 percent of wholesalers said business is “OK”; 36 percent said “good”; 7 percent said “terrible.”

Stepping back to look at overall sales expectations for the year:

- Three quarters of growers said they are “optimistic” about sales this year. The rest are “neutral or uncertain.”

- 43 percent of wholesalers are “optimistic” about sales for 2016; 36 percent are “neutral or uncertain;” 7 percent are “very optimistic;” 7 percent are “pessimistic.” About the same percentage are “very pessimistic.”

- 45 percent of retailers said they are “optimistic” about sales for 2016; 31 percent said they are “neutral or uncertain”; 11 percent are “pessimistic”; 11 percent are “very optimistic.” Less than 2 percent are “very pessimistic.”

The Ups and Downs

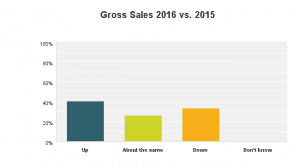

About 40 percent of total respondents said second quarter gross sales were up this year, compared to the same quarter in 2015. Twenty-six percent said they were about the same and about 33 percent said they were down.

Breaking those results down by segment:

- 75 percent of growers said gross sales were up compared to the same quarter last year.

- Wholesalers were more divided: 36 percent said sales were up; 29 percent said they were about the same and 36 percent said they were down.

- Meanwhile, 39 percent of retailers said gross sales were up compared to the same quarter last year; 26 percent said they were about the same; 34 percent said they were down.

Among total respondents who said gross sales were down this quarter compared to the same quarter last year, 68 percent said the decline fell in the 1- to 10-percent range. Nearly a quarter said they experienced a drop-off between 11 and 20 percent.

Source: 2016 Second Quarter Economic Outloook Survey, emailed July 10 to SAF members 8 percent response rate.

Among respondents who said gross sales were up, 71 percent said the increase was 1 to 10 percent. Nineteen percent classified their gains as between 11 and 20 percent.

Sixty-six of all respondents who said net profits are down from the same quarter last year said the decline was in the 1- to 10-percent range. Twenty-one percent said net profits are down 11 to 20 percent.

Seventy-nine percent of all respondents who said net profits are up said the increase was between 1 and 10 percent. About 17 percent said they had seen net profits rise 11 to 20 percent.

Staffing Plans and Challenges

Because staffing is an ongoing issue for floral industry members across segments, respondents answered a number of detailed questions on the topics.

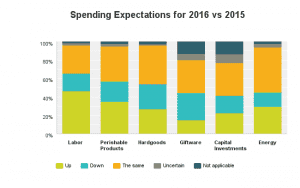

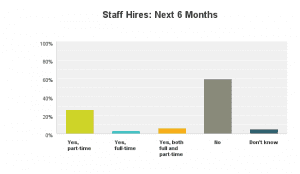

While nearly 60 percent of all respondents said they do not anticipate adding more staff in the next six months, 47 percent of respondents said they expected to spend more this year on labor. (The question on staff additions asked respondents to exclude seasonal and holiday help in their answer).

About a quarter of respondents said they will hire part-time staff in the next six months.

Source: 2016 Second Quarter Economic Outloook Survey, emailed July 10 to SAF members 8 percent response rate.

“Business is steady and solid,” said one Minnesota grower. “ biggest challenge is hiring and retaining entry-level workers.”

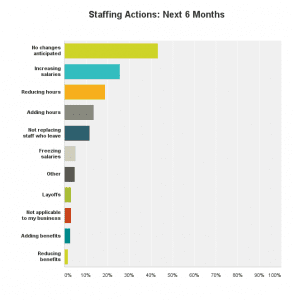

About 43 of all respondents said they have no staffing changes planned for the next six months. About 19 percent said they’ll be reducing hours, but 14 percent said they’ll add hours. Nearly 12 percent said they will not be replacing staff members who leave.

A quarter said they plan to increase salaries and/or pay, but several respondents noted that the intention shouldn’t be misinterpreted: In many cases, business owners don’t have a choice, because of a “tight labor market,” as one California wholesaler explained it.

State laws and regulations can also come into play. A wholesaler in Oregon said they had been “forced to raise salaries, as the minimum wage is going to increase to $15 per hour.”

Source: 2016 Second Quarter Economic Outloook Survey, emailed July 10 to SAF members 8 percent response rate.

About 42 percent of total respondents said they have had a difficult time attracting non-seasonal candidates for experienced design positions; 32 percent said they’ve had a difficult time attracting non-seasonal candidates for entry-level positions (e.g. sales, processing and production). Forty-one percent said they have not needed to hire additional non-seasonal employees in the past 12 months.

Meanwhile, only 13 percent said they have a difficult time retaining qualified employees and only 12 percent said they have a difficult time attracting non-seasonal candidates for management positions.

Look for more coverage of survey results in Floral Management magazine — including practical tips on ideas that have helped improve the economic picture for individual businesses.

Love this kind of industry-specific insight and want the opportunity to talk shop with your peers? It’s not too late to sign up for SAF Maui 2016, SAF’s annual convention, Sept. 21-24.