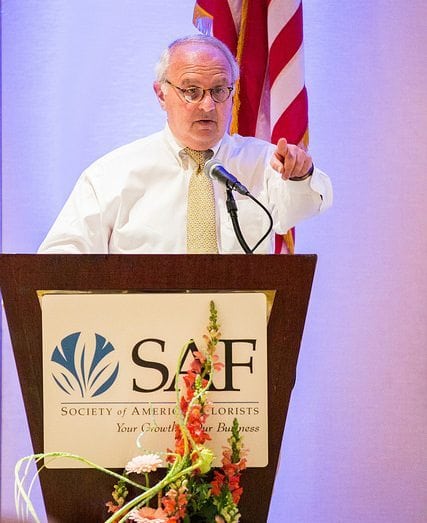

The MyRA program for retirement savings “is one of those programs that could benefit the vast majority of SAF members and potential members in our industry,” said Tim Galea of Norton’s Flowers & Gifts.

A longtime retail flower shop is at the forefront of a new effort to encourage more Americans to save for retirement.

Thanks to a connection forged by the Society of American Florists (SAF), Norton’s Flowers & Gifts, in Ypsilanti and Ann Arbor, Michigan, is the first florist in the country to participate in the U.S. Treasury Department’s new myRA program.

Billed as a “starter account” to encourage retirement saving, the program lets workers automatically deduct money from their paychecks. (MyRA is short for My Retirement Account.) They also can contribute to the accounts directly, using electronic transfers from a checking or savings account. Making the program even more attractive to low-wage earners, no minimum deposit is required, no fees are charged, and depositors have no risk of losing money.

“It costs us nothing to participate, and, from an administrative perspective, it’s as simple as a payroll deduction — that’s all we have to do,” said Tim Galea, president of Norton’s. “I’m happy to share this program with our employees because I know how hard they work every day and they don’t have a lot of disposable income.”

Galea first heard about the program through SAF. Two years ago, the Treasury Department was on the hunt for business owners to participate in myRA’s pilot program, and representatives reached out to SAF and other trade groups.

Galea started signing up employees late last spring. At press time, about six of his 21 employees were participating in the program.

Through myRA, workers may contribute up to $5,500 a year, or $6,500 if they are 50 or older, with a maximum total of $15,000. (As government officials are quick to note, the $15,000 ceiling is an indicator that these accounts are “starter” funds, to help people begin the process of saving.) Participants may withdraw their contributions tax-free and without a penalty, so the money can be used for emergencies. The accounts are not tied to a specific employer, so they go with workers who change jobs.

Galea’s enthusiasm for the idea and willingness to work closely with the government to improve it during the pilot period also attracted the attention of Treasury Department officials, who last month sent a video team to Norton’s to create a short promo for myRA. In that video, Galea and two of his young employees, Cat Jensen and Tom Stimpson, discuss the merits of the program.

“I hadn’t really thought about retirement before because there weren’t that many options,” Stimpson said. “It’s reassuring that I have a fund started.”

For Jensen, myRA “is like a second layer” to complement other savings efforts. “It makes me feel great,” she said. “It’s like a weight’s lifted off my shoulders.”

Those kinds of comments are representative of the positive feedback Galea has gotten from all of his participating employees, he said.

As employers, “it makes us look like a hero,” he explained. “From the employee’s perspective, it’s a benefit, but it’s a benefit that doesn’t cost us anything. It’s crazy not to look at this and consider offering it to your team.”

Last week, the government began promoting myRA to a larger audience, beyond the test market, and Norton’s became a go-to stop for reporters looking for small business stories. In the past 10 days, the shop has been featured in USA Today, The New York Times and on NBC Nightly News.

For his part, Galea said he’s happy to be a face of the new program. “This has been a great opportunity to get the floral industry out in front of a media buzz that doesn’t cost us anything,” he said. “This is one of those programs that could benefit the vast majority of SAF members and potential members in our industry.”