Source: SAF Economic Outlook Survey, Q1 and Q2. Emailed July 16, 2017, to SAF members. 9.3% response rate.

How’s business? Pretty good! That was the generally cheery picture that emerged from a recent Society of American Florists survey on first and second quarter returns. Forty-eight percent of all respondents — including growers, wholesalers and retailers — reported business is “good.” Another 9 percent called it “excellent.”

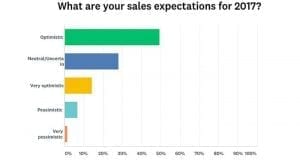

About 33 percent classified business as “OK,” and roughly 9 percent classified it as “poor” or “terrible.” Overall, nearly half of all respondents said they were “optimistic” about 2017 sales, compared to 2016 results, and an additional 14 percent said they were “very optimistic.” (Twenty-eight percent said they were “neutral.” About 8 percent classified themselves as “pessimistic” or “very pessimistic.”)

Forty-nine percent of all respondents said first and second quarter gross sales were higher this year, compared to the same period last year. About 26 percent said they were roughly the same. Twenty-two percent said sales were down comparatively. (Two percent weren’t sure.

Source: SAF Economic Outlook Survey, Q1 and Q2. Emailed July 16, 2017, to SAF members. 9.3% response rate.

Modest Decreases and Gains: A Look at Overall Responses

Here are some additional findings from the survey, based on responses from industry members from all segments. (Keep reading for a breakdown by segment.)

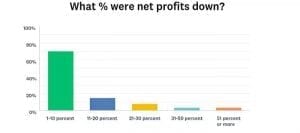

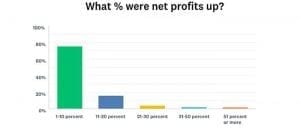

- Among respondents who said sales were down from the same period last year, 65 percent said the decrease fell between 1 percent and 10 percent. Among all respondents who said net profits were down from the same period last year, about 70 percent said they dropped from 1 percent to 10 percent.

- Among those who said sales were up, 64 percent said the increase was in that same range (1 percent to 10 percent). Among respondents who said net profits were up, 75 percent said the increase was between 1 percent and 10 percent.

- Nearly 56 percent of all respondents said they have no plans to add permanent staff in the next six months. (The question asked them to exclude seasonal and holiday hires). About 28 percent said they’ll add part-time staff only in that period. Overall, about 41 percent said they have no plans to make any staffing adjustments, including hour and compensation adjustments in the next six months. About 27 percent plan to increase salaries/pay and 18 percent plan to add hours. Only about 3 percent are predicting layoffs.

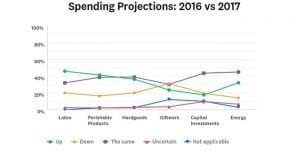

In terms of spending projections:

- 46 percent of all respondents expect to spend more on labor this year.

- 41 percent predict they’ll spend more on perishable product.

- Thirty-eight percent expect to spend the same on hard goods — 36 percent said they plan to spend more.

- About 31 percent plan to spend less on giftware, compared to 23 percent who anticipate spending more.

- 44 percent say they’ll likely spend the same amount on capital investments.

- 45 percent are planning for flat energy costs.

Source: SAF Economic Outlook Survey, Q1 and Q2. Emailed July 16, 2017, to SAF members. 9.3% response rate.

Breaking Down by Segments

Here are additional highlights from the survey, presented by segment:

Retailers

Overall: Among retailers, 48 percent of respondents classified business as “good” and 10 percent said it was “excellent.” About a third said it was “OK” and 7 percent said “poor”. (Less than 2 percent said “terrible.”)

Spending: Forty-four percent of retailers plan to spend more on labor this year; 43 percent are predicting an increase in perishable product spending. About 40 percent say they expect hard good costs to remain the same while 38 percent predict an uptick. Respondents were evenly divided among expectations for giftware spending (25 percent up, 31 percent down, 32 percent flat). Forty-three percent of retailers predict increases in capital investments and 45 percent predict higher energy costs.

Source: SAF Economic Outlook Survey, Q1 and Q2. Emailed July 16, 2017, to SAF members. 9.3% response rate.

Staff: About 56 percent of retailers said they will not hire any permanent staff in the next six months; about 30 percent said they do plan to bring in part-time help. Meanwhile, while 43 percent of retailers predict no staffing changes, 25 percent anticipate increasing salaries and 18 percent said they’ll add hours. A number of respondents said they’re taking the work of building a bench of talent into their own hands. A florist in Knoxville said the business is focsed on “professional development — design classes and sales training to help boost confidence and creativity.”

Wholesalers, Suppliers, Importers

Overall: About 55 percent of wholesalers, suppliers and importers said business is “good.” Around 36 percent said business is “OK” and nine percent said it was “poor.”

Spending: Among this group, 45 percent plan to spend more on labor and perishable products this year. About 55 percent plan to spend more on capital investments and 45 percent predict energy costs will be higher.

Staff: About 36 percent said they’ll be hiring full- and part-time staff in the next six months. Another 36 percent said they have no plans to bring on any permanent staff in that period. Forty-five percent of this group plans to increase salaries or pay. “Finding good people is very difficult at this time,” explained one wholesaler in Oregon — a sentiment shared among segments. “Providing a good work environment is helping to retain people.”

Growers

Overall: Sixty-nine percent of grower respondents said business is “good.” About 31 percent said it was “OK.”

Spending: About 85 percent of growers expect to spend more on labor this year; 54 percent predict energy costs will be flat and 62 percent say they are expecting capital investment expenditures to be comparable to 2016.

Staff: Only about 23 percent of growers plan to hire full- or part-time permanent staff in the next six months. Forty-six percent of these respondents do plan to increase salaries or pay in that time period. A number of respondents said they’ve become more proactive about reaching out to local schools and universities to bring in talent. And some are getting even more creative, looking for opportunities in places other employers might write off. “ working with young people who were classified ‘at risk’ in high school,” wrote one grower in Minnesota.

Look for more coverage of the survey—including some ideas respondents have put in action and are ready to share — in future issues of EBrief and SAF’s Floral Management.